Patient eligibility verification errors account for a staggering percentage of claim denials across healthcare practices. In fact, 50% of all claim denials stem from incorrect billing information entered on the front end, before the claim even leaves your office.

The good news? Most of these mistakes are completely preventable with the right systems and awareness. We've worked with countless therapy practices to identify and eliminate these common verification pitfalls, and we're sharing exactly what we've learned.

Let's dive into the seven most costly eligibility verification mistakes, and the practical fixes that can transform your revenue cycle.

Mistake #1: Inaccurate or Incomplete Patient Information

The Problem:

Even minor errors create major headaches. A misspelled name, transposed birth date, outdated address, or missing subscriber ID can cause your eligibility verification to fail completely. These details must match both the patient's Electronic Health Records and their insurance documentation precisely, no exceptions.

Think about it: insurance systems are looking for exact matches. One wrong digit in a date of birth or a nickname instead of a legal name? Your verification bounces back.

The Fix:

Create a standardized intake checklist that your front desk team uses for every single patient. This isn't about adding work, it's about doing it right the first time.

Your checklist should capture:

✓ Full legal name (as it appears on the insurance card)

✓ Date of birth

✓ Current address and phone number

✓ Primary subscriber ID and group number

✓ Secondary insurance policy details (if applicable)

✓ Insurance company phone number directly from the card

Make it a practice to verify information with the patient at every visit. Insurance changes happen frequently, and catching updates early prevents claim denials later.

Mistake #2: Skipping or Delaying Pre-Visit Verification

The Problem:

Waiting until check-in, or worse, after the appointment, to verify coverage is a recipe for avoidable denials and payment delays. This reactive approach triggers a cascade of billing problems that affect your entire revenue cycle.

When you don't verify coverage before the patient walks through your door, you risk providing services that won't be reimbursed. That creates awkward conversations, billing disputes, and frustrated patients.

The Fix:

Build pre-visit verification into your scheduling workflow. Verify insurance details 24–48 hours before every appointment.

This window gives you enough time to:

✓ Address any discrepancies directly with the patient

✓ Obtain necessary pre-authorizations

✓ Inform patients of potential out-of-pocket costs

✓ Reschedule if coverage issues can't be resolved quickly

When verification becomes a pre-appointment standard rather than an afterthought, you eliminate surprises for both your team and your patients. That's how you create a smoother billing experience from start to finish.

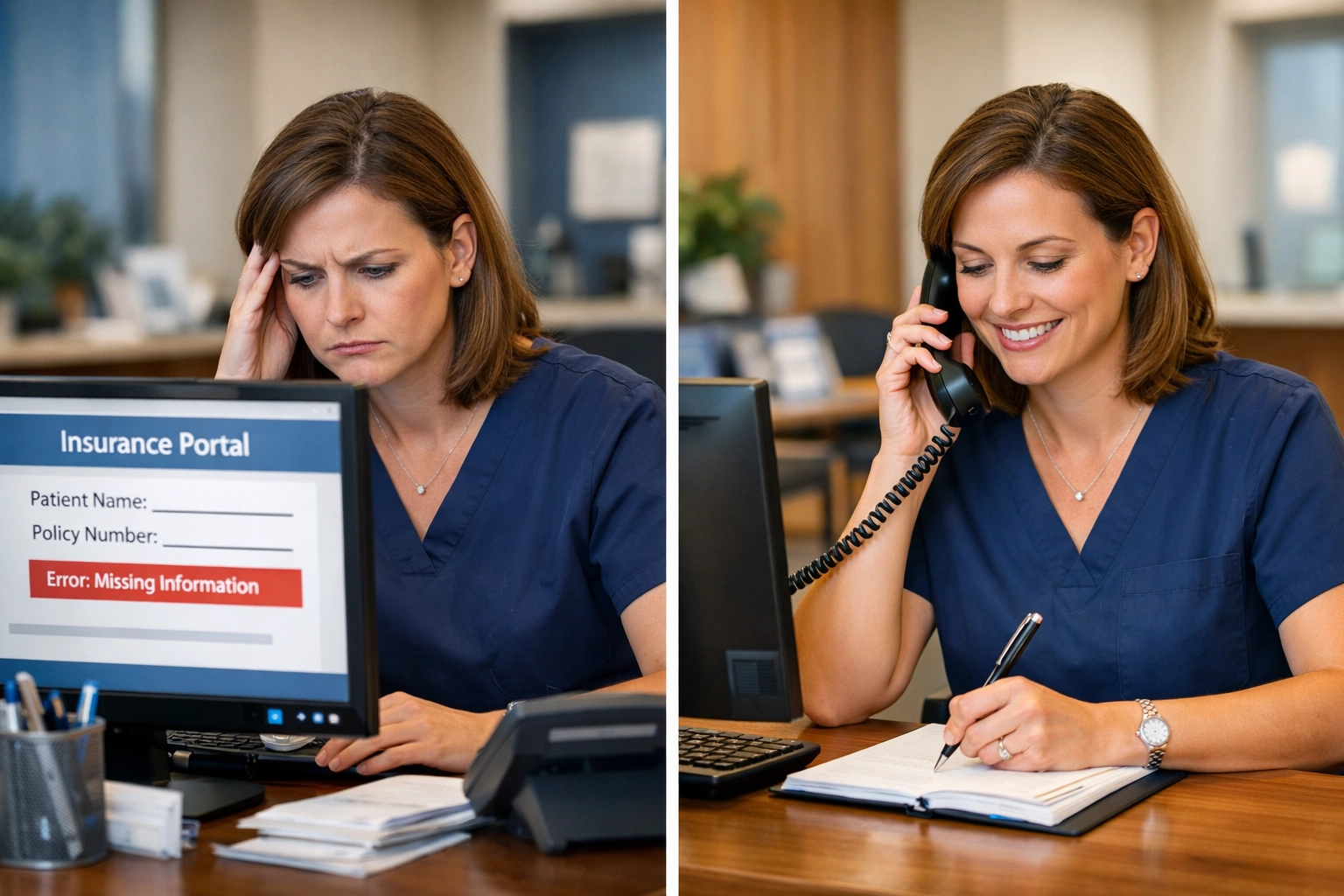

Mistake #3: Relying Solely on Online Portals or EMR Verification Tools

The Problem:

Insurance portals like Availity and EMR-integrated verification tools are convenient, but they're far from comprehensive. These automated systems typically provide only about 40% of the information you actually need to bill confidently.

What they often can't tell you:

- Whether specific CPT codes require prior authorization

- How many therapy visits remain in the patient's benefit period

- Whether referrals are needed

- Exact copay and deductible amounts for your specific services

The Fix:

Use online verification tools as your starting point, not your finish line. They're excellent for confirming active coverage and basic benefit information, but supplement them with direct payer contact for complete details.

For therapy billing specifically, we recommend calling the insurance company to verify:

✓ Authorization requirements for the planned services

✓ Remaining visit limits for the benefit period

✓ Patient's current deductible and out-of-pocket maximums

✓ Any coordination of benefits with secondary insurance

Yes, this takes more time upfront. But it saves countless hours of appeals, resubmissions, and revenue recovery efforts on the backend.

Mistake #4: Sending Excessive or Incorrect Patient Data

The Problem:

Here's a counterintuitive issue: sending too much patient data in your eligibility requests can actually cause verification failures. Payers require exact matches to identify a single patient, and extra data fields: especially those containing typos or unnecessary information: increase the risk of mismatches and AAA errors.

When your system submits more fields than required, you're creating additional opportunities for discrepancies that trigger rejections.

The Fix:

Keep your eligibility requests lean and precise. Send only the data fields that each specific payer requires: nothing more.

Work with your practice management software vendor or billing team to configure verification requests that include:

✓ Only the minimum required patient identifiers

✓ Clean, validated data without extraneous fields

✓ Information that matches exactly what's on file with the payer

This streamlined approach reduces matching errors and improves your first-pass verification success rate.

Mistake #5: Not Verifying Coverage Changes or Secondary Insurance

The Problem:

Patients change jobs, switch plans, add spouses to their insurance, and experience coverage gaps: often without updating your office. When you continue billing outdated insurance information, your claims get denied or misrouted.

Secondary insurance coordination adds another layer of complexity. Many patients carry multiple policies, and billing them in the wrong order or missing a secondary policy entirely creates reimbursement delays.

The Fix:

Make insurance updates a routine part of every patient encounter. At minimum, ask patients to confirm their coverage at check-in and update any changes immediately.

For secondary insurance, develop a specific verification protocol:

✓ Ask directly about secondary coverage (many patients don't volunteer this information)

✓ Verify coordination of benefits rules with both insurers

✓ Confirm which policy is primary and which is secondary

✓ Document both policies in your practice management system

Creating a culture of "verify every time" prevents the accumulation of outdated information that leads to denials down the line. For more insights on front desk accuracy, check out our article on capturing insurance information correctly.

Mistake #6: Overlooking Authorization Requirements and Service-Specific Benefits

The Problem:

Active insurance coverage doesn't automatically mean the specific service you're providing is approved. Missing pre-authorization for required procedures is one of the most frequent causes of eligibility denials: even when the treatment is medically necessary.

This is particularly critical for therapy practices, where different CPT codes may have different authorization requirements, visit limits, or coverage criteria.

The Fix:

Go beyond basic eligibility and verify service-specific coverage for every procedure you plan to bill. This means confirming:

✓ Whether the specific CPT codes require prior authorization

✓ How many units or visits are approved

✓ Whether there are restrictions on frequency or duration

✓ If there are any medical necessity documentation requirements

Build authorization tracking into your scheduling and treatment planning process. When your team knows what's approved before providing service, you avoid the frustration of delivering care that won't be reimbursed.

Our proven denial prevention framework can help you establish systematic authorization workflows.

Mistake #7: Not Knowing Your Practice's Network Status and NPI Credentialing

The Problem:

Here's a mistake that catches even experienced practices off guard: not verifying their own network status or which NPI they're credentialed under with each payer. This oversight leads to claim routing errors, unexpected out-of-network rates, and reimbursement issues.

Many practices assume they're in-network with certain insurers without confirming, or they don't realize they need to use a specific group NPI versus an individual provider NPI for certain claims.

The Fix:

Take control of your credentialing knowledge. Don't rely solely on insurance representatives or outdated information.

Action steps:

✓ Contact your biller or credentialing specialist to review your current status

✓ Examine the actual contracts and participation agreements you've signed

✓ Maintain an updated list of your network status with each major payer

✓ Verify which NPI numbers (individual vs. group) are credentialed for each contract

✓ Set calendar reminders to re-verify network status quarterly

This knowledge protects your practice from accidentally billing as out-of-network and helps you counsel patients accurately about their expected costs.

The Bottom Line: Automation and Standardization

Eligibility verification doesn't have to be a source of constant claim denials and revenue disruption. When you implement integrated practice management software with real-time eligibility checking and standardized verification protocols, you reduce human error dramatically.

The most successful therapy practices we work with have:

✓ Automated pre-visit verification workflows

✓ Standardized checklists for every team member

✓ Clear escalation procedures for verification issues

✓ Regular training on common verification pitfalls

✓ Quality assurance reviews of verification accuracy

These systems create consistency, reduce denials, and accelerate your revenue cycle: giving you peace of mind and more predictable cash flow.

Ready to Eliminate Verification Errors?

At ALS Integrated Services, LLC, we specialize in helping therapy practices streamline their eligibility verification processes and reduce claim denials. Our team understands the unique challenges of therapy billing, and we've developed proven systems that catch errors before they become denials.

Whether you're struggling with high denial rates, inconsistent verification processes, or simply want to improve your front-end revenue cycle, we're here to help.

Let's talk about how we can support your practice. Visit alsintegratedsvc.com or explore our billing insights to learn more about building a stronger revenue cycle.

Your verification process should work for you( not against you.) Let's make that happen.